Impact of Rising Repo Rates by RBI

The Reserve Bank of India is the main pillar in portraying and controlling inflation, which specifies the country's overall economic flow. The RBI's Monetary Policy influences factors such as inflation and economic stability.

Inflation has risen in recent months due to rising crude oil prices caused by the Russia-Ukraine conflict. To combat global inflation, the Reserve Bank of India has raised repo rates. The RBI hiked the repo rate by 50 basis points to 4.90 percent from 4.4 percent earlier, according to the announcement. This is the second increase this year; the first was by 40 basis points.

The decision comes amid rising inflation and a weakening of the Indian rupee as interest rates in the United States rise. Leading banks such as the State Bank of India, HDFC, and ICICI Bank raised lending rates by up to 10 basis points, making home loans more expensive for home buyers.

Historical Repo Rate Chart | Source: tradingeconomics

Changes in repo rates impact the economy by controlling the flow of cash through it. The RBI lowers interest rates to inject more money into the economy. It slows down the economy as the repo rate rises.

Let’s see how can this repo rate hike impact the different sectors of India.

What is the Repo Rate?

A repo rate is the interest rate at which the Reserve Bank of India lends money to commercial banks or financial institutions. It lends money in exchange for government securities.

When there is a shortage of funds, the RBI lends funds to commercial lenders at the repo rate. The repo rate is used by monetary authorities to control inflation. During periods of high inflation, the RBI raises the repo rate, which acts as a deterrent for banks to borrow from it. Raising the repo rate lessens the supply of money and aids in the containment of inflation. Correspondingly, when an economy is in a stable period, the RBI can lower the repo rate, and lending institutions can pass the profit on to banks.

Possible reasons for the hike in the repo rate by RBI

Rising Inflation

A few weeks ago, RBI governor Mr. Shatikanta Das stated unequivocally that the country's central bank will now prioritize containing inflation over stimulating growth. According to data released last month by the Ministry of Statistics and Programme Implementation, the Consumer Price Index (CPI) rose to 6.95 percent in March 2022, setting a new high in the previous 17 months.

Historical CPI Inflation Chart | Source: tradingeconomics

Retail inflation, which was 6.06 percent in February, increased by 0.89 percent in March. The level exceeded economists' perceptions of 6.35 percent. Moreover, inflation exceeded the RBI's upper band of 6% in the first three months of 2022. The ascent in the Food Index is the primary driver of the overall rise in retail inflation. By increasing the repo rate, the RBI hopes to halt economic borrowing and demand to maintain inflation under control.

Global Economic Pressures

The reaction to rising inflation has been well documented by major economies such as the United States, Russia, and European countries. The US Federal Reserve recently raised interest rates by 50 basis points (bps). This is the largest rate increase in the last 20 years, and it suggests that more rate increases are on the way. All of this, combined with domestic inflation, has put pressure on the Indian economy and the Reserve Bank of India to make global changes.

Increase in Government Bond Yields

The benchmark 10-year government yield in India recently increased to 7.12 percent, the highest in the last two years. Following the announcement of the interest rate hike by the RBI yesterday, the bond yield increased by 26 basis points. Although bond yields have risen due to speculation about an interest rate hike rather than any other factor, the rising yield has served as a dangerous sign of a repo rate hike.

Geopolitical Uncertainties

The Russia-Ukraine crisis is exacerbating the already severe inflation. The rise in crude oil prices, which has driven up the prices of almost all other goods, is unlikely to slow shortly. The crisis has also caused havoc in the global supply chain. The number of penalties placed on Russia by the US and European nations, as well as Russia's sharp retorts, have calmed fears and instabilities in the global economy. In such a situation, one cannot hope the RBI to continue pump money into the market while putting inflation on the back burner.

Impact of rising repo rates

Impact on economy

Experts believe that the RBI's decision to raise repo rates was correct, given the global backdrop of the Fed's rate policy, rising oil prices, and the fact that many emerging economies have already raised their rates. To defend their currencies, emerging markets are raising interest rates. However, some experts are concerned that the increase in the repo rate will harm the economy's recovery from the effects of demonetization and the implementation of GST (Goods and Services Tax).

Reduce inflation

Banks will be forced to pay more interest to the Reserve Bank of India as the repo rate rises, prompting them to raise loan rates for their consumers. Borrowers are then discouraged from obtaining credit from banks, leading to a lack of funds and liquidity problems in the economy. So, on the one hand, inflation is controlled because there is less money in the hands of the public to spend, but growth suffers because corporations avoid taking out loans at high-interest rates, resulting in a shortfall in growth and production.

Possible hike of interest in Bank FDs

The accessibility of funds for commercial banks is limited as the repo rate rises because banks will not be willing to borrow at the repo rate. In turn, they might have to hike the interest rates on deposits for attracting depositors. Consequently, a rise in the repo rate increases the likelihood of high-interest rates on fixed deposits.

Increase in Government Bond/ GSec Yields

The benchmark 10-year government yield in India recently increased to 7.12 percent, the highest in the last two years. Following the announcement of the interest rate hike by the RBI yesterday, the bond yield increased by 26 basis points. Although bond yields have risen due to speculation about an interest rate hike rather than any other factor, the rising yield has served as a dangerous sign of a repo rate hike.

Costlier Home Loan

Current borrowers' EMI liability will only grow now that banks have begun raising interest rates. However, such an increase in EMI would be noticed by borrowers only when their home loan's reset date arrived. On that date, future EMIs would be calculated using the MCLR in effect at the time.

Impact on Vehicle loan

The unexpected move by the RBI to raise the repo rate will cause all banks to raise loan interest rates. So, vehicle loans will become more expensive in the future. If any of you are considering taking out a loan, you should act quickly because interest rates on loans may begin to rise soon.

Furthermore, the repo rate increase is bad news for existing borrowers because banks and other financial institutions will soon begin raising interest rates on loans, which means that vehicle loan EMIs will rise as well. The latest RBI policy decision will have an impact on all loans, whether they are car loans or personal loans.

Impact on the stock market

An increase in the repo rate means higher borrowing costs for banks, which will be reflected in the interest rate on loans lent to general borrowers like us. This will further reduce economic spending and demand. Reduced demand will force businesses to curtail their growth and decrease their output of goods and services. This will stop growth, causing investors to withdraw funds from the market, and will cause stock prices to fall. This is not just a theory; the inverse relationship between the repo rate and the stock market has long been observed

What Should Investors Do?

First and foremost, there is nothing to be concerned about! The rise and fall of the repo rate is a natural and healthy way of controlling key economic metrics. To promote long-term growth, inflation must be immediately controlled. Having said that, it is also true that an increase in interest rates will have an immediate and negative impact on investments. So, what should be done?

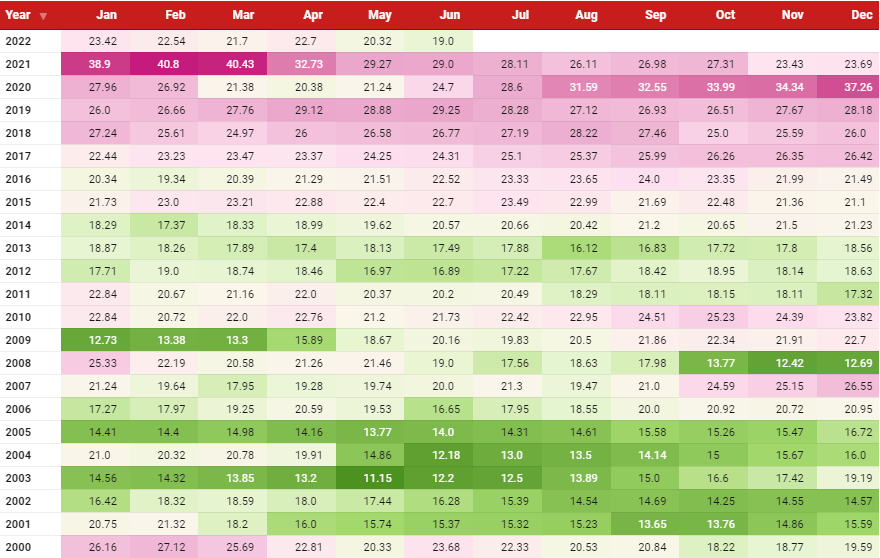

This time can be an accumulation phase for equity investment. The P/E ratio of the NIFTY index is currently below 20, and it looks like an oversold market. If you analyze the history of the Indian stock market, it tells that an index P/E below 20 is nearly undervalued. Lumpsum equity investments in phases or starting a new SIP for the long term make sense in the current situation.

Historical Nifty P/E Table | Source: primeinvestor

This is a good time for fixed-income investors because interest rates are rising and the long-term G-Sec yield is more appealing. Also, from a financial planning standpoint, this market condition is a good time to accumulate good stocks.