Retirement Calculator | Plan and Calculate Your Retirement Corpus

Do you want to plan your retirement? If yes, you are in the perfect place. Finlive's (In) retirement calculator brings you the most practical factors required to plan a retirement. Within a few clicks, you can measure your future expenses, target investments, and the capital required to achieve your happy retirement journey. So, let's discuss how you can use the retirement calculator.

Let's understand the meaning of the inputs and outputs of the retirement calculator:

- Current Monthly Expense (Rs.): This input is nothing but the approximate amount you spend to run your household every month.

- Your Age: Your current age

- Retirement Age: The age you wish to retire. Eg. if you want to retire at the age of 45, then you need to provide 45 in this input.

- Life Expectancy: To calculate the retirement corpus life expectancy is required. 'Life Expectancy' refers to the number of years a person can expect to live.

- Est. Annual Inflation Rate (%): Inflation is the rate of rise of goods and services. Alternatively, you can say the reduction of currency value. From an Indian perspective, we can take a 3 to 4% long-term average inflation rate.

- Pre-Retirement Lifestyle Expenses Growth Rate (%): Estimated growth rate of your expenses before retirement on an annual basis.

- Post Retirement Lifestyle Expenses Growth Rate (%): Estimated growth rate of your expenses after retirement on an annual basis.

- Post Retirement Annuity Rate (%): Assume, in the event of your retirement, you are buying a pension plan for retirement corpus. Buying a pension plan with a fixed interest rate is called buying an annuity plan. It's generally a one-time investment that gives periodic recurring cash inflow.

How to use the Retirement Calculator?

Planning retirement using the Retirement Calculator is pretty simple and easy too. You only need to provide a few inputs and click on the Calculate Now button. Let's Understand the calculator with an example:

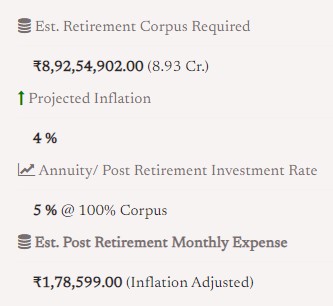

In the following example, we will discuss a guy with a current monthly expense of 40k, and his age is 30. He expects his expense rate will increase by 2% annually due to his improved lifestyle. He expects that he shall retire from his job on his 55th birthday. He also expects his post-retirement expenses will increase by 5% each year due to some medical expenses. Now, with this criteria, the person wants how much corpus will be sufficient to fulfill his post-retirement expectations. So let's fill in the Retirement calculator:

|

Current Monthly Expense (Rs.): 40,000 Your Age: 30 Retirement Age: 55 Life Expectancy: 80 Est. Annual Inflation Rate: 4% Pre Retirement Lifestyle Expenses Growth Rate: 2% Post Retirement Lifestyle Expenses Growth Rate: 5% Post Retirement Annuity/ Investment Rate: 5% |

|

|---|---|

|

|

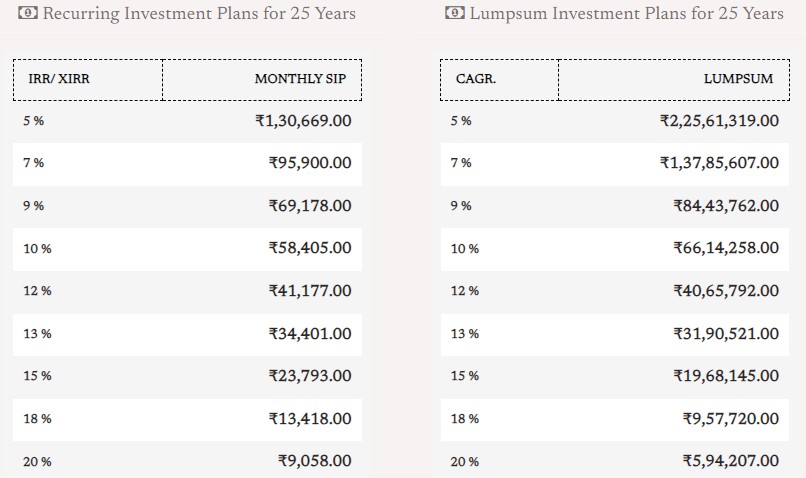

Now, with these inputs, we will get an estimated amount of 9 Cr. that will be required for the person during his retirement. Not only this the Retirement Calculator will also present how much you need to invest periodically to achieve his retirement goal. Isn't that great? Let's plan your retirement. If you need more information or any suggestions please provide your inquires and comments in the comments section.