Wealth Calculator Pro | Multi-Asset Wealth Calculator

What is the multi-asset wealth calculator?

Investing in multiple asset classes is not a new thing. In order to balance and hedge our financial portfolio, we often plan different investment instruments. But, the problem is that getting a retrospective view of all investments over a period of time is somewhat difficult. The multi-asset wealth calculator helps you to solve this problem. You can discover thousands of financial calculators on the internet, but measuring all investments in a single calculator is rare. In a short, multi-asset wealth calculator enables you to measure and calculate all of your investments on a single page. Not only this, you will have a year-on-year view and a consolidated view of each investment.

How to use the multi-asset wealth calculator?

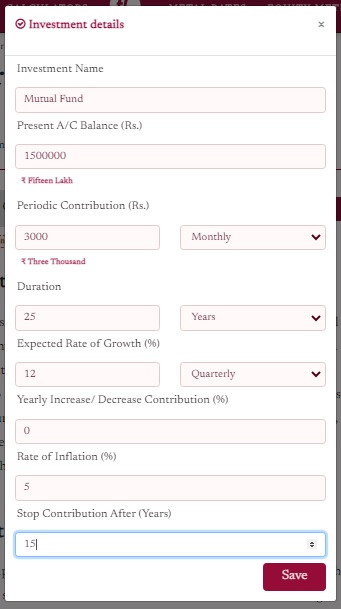

The multi-asset wealth calculator is simple and easy to use. All you need to start with a click on the 'Add Investment' button. This will show the 'Investment Details' window. Fill in the following details and click on the 'Save' button:

|

|

|

|

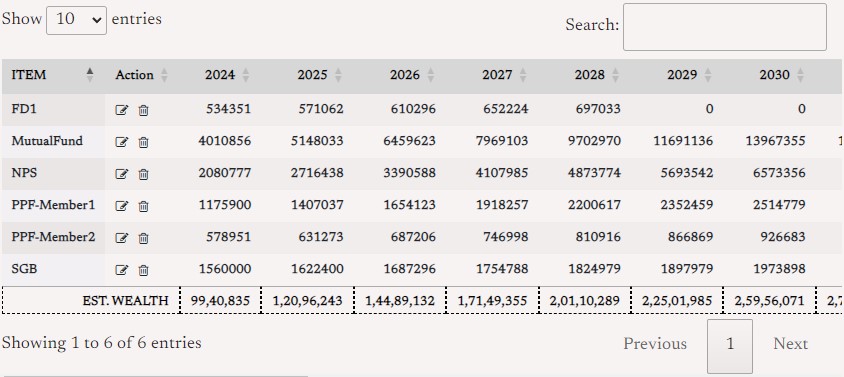

Once you save with details a new entry will appear on the calculator page. In this way, you can add multiple investments one after one.

Supported investment classes by multi-asset wealth calculator

You can plan almost all kinds of investments over the multi-asset wealth calculator. It supports recurring, one-time & mixed investment calculation. Not only these, the calculator also supports some critical financial parameters like inflation and incremental or decremental periodic investments. One special parameter of 'Stop contribution' is ideal for the calculation of those investments, in which you are supposed to stop making contributions a few years earlier than the maturity.