PPF vs ELSS: Detailed Comparison & Which is Better

Long-term investments are primary tools that have the potential to make wealth as well as beat inflation. Inflation is nothing but the wealth depreciation for the price appreciation of consumable items. Public Provident Fund and Equity Linked Savings Scheme are the most preferred long-term tax-saving investment schemes in India. PPF is a classic but the most popular long-term saving scheme in India that comes with an attractive interest with a bucket of tax benefits. On the other hand, ELSS is a comparatively new long-term investment scheme gaining popularity nowadays.

Are you confused to decide which is a better option for you? After going through this article, it will be easier to figure out either PPF or ELSS is a better investment option for you. Let's understand each scheme one by one:

Public Provident Fund (PPF)

Public Provident Fund (PPF) is a Government-sponsored long-term savings scheme applicable for residents of India. The saving-scheme fetches a fixed interest rate for a quarter. As of Feb 2021, the current interest rate of the PPF scheme is 7.1% that compounds annually. Investments under PPF matures in 15-years. The investment scheme is ideally known for its tax benefits. Including investments, returns are also exempt from tax. Due to this, PPF is categorized as EEE (Exempt-Exempt-Exempt) saving scheme.

Equity Linked Saving Scheme (ELSS)

Are you looking for an investment with tax benefits? Well, there is certainly an option for you. ELSS or Equity Linked Saving Scheme is a saving instrument that allows you to invest in the equity markets. Along with this, the scheme offers a tax deduction of up to Rs. 1.5 lakh per financial year. However, returns from ELSS are not tax-free and applicable for LTCG (Long-Term Capital Gain) tax. ELSS is also a long-term investment scheme where the lock-in period is for 3-years.

10 Best Performing ELSS Mutual Funds in 2021

| ELSS Fund Name | 5-Year Returns* | Expense Ratio* |

|---|---|---|

| DSP Tax Saver Fund | 18.15% | 0.85% |

| Mirae Asset Tax Saver Fund | 24.25% | 0.28% |

| Canara Robeco Equity Tax Saver | 19.65% | 1.08% |

| BOI AXA Tax Advantage Fund | 20.05% | 1.51% |

| Axis Long Term Equity Fund | 18.12% | 0.72% |

| SBI Tax Advantage Fund - Series III | 25.25% | 2.6% |

| Aditya Birla Sun Life Tax Relief 96 | 24.05% | 1.28% |

| Motilal Oswal Long Term Equity Fund | 18.17% | 0.72% |

| Kotak Tax Saver Scheme | 18.07% | 0.85% |

| IDFC Tax Advantage (ELSS) Fund | 18.50% | 18.45 |

PPF Vs. ELSS

PPF and ELSS, both schemes are fundamentally different from each other. Each investment scheme comes with some individual pros and cons. Public Provident Fund is a risk-free debt-oriented investment option, whereas ELSS mostly invests in equity stocks that can produce better returns than PPF. However, there also credit risk associated with investments in equity stocks. Let's understand the benefits and drawbacks of each scheme one by one:

Returns

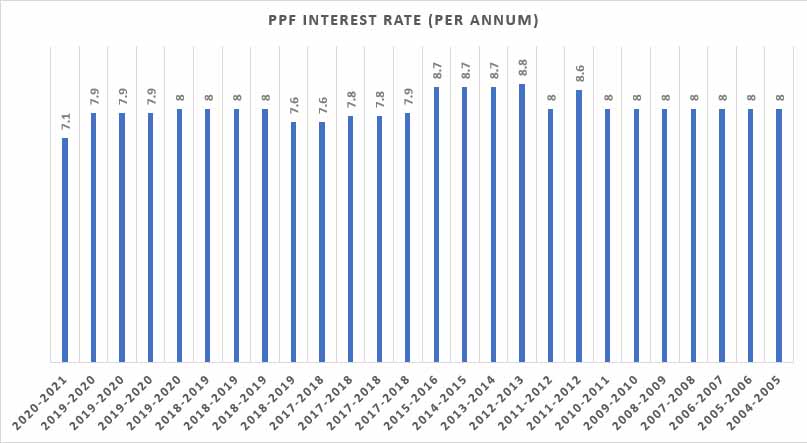

From the returns perspective, both schemes are entirely different from each other. Neither PPF nor ELSS offers a fixed rate of return. However, the return of PPF is likely to be fixed for a financial quarter. The interest rate of PPF is significantly declining years by years. On average, you can expect 7 to 8 percent of annual returns on your Public Provident Fund account.

PPF Historical Interest Rate Chart

PPF Historical Interest Rate Chart

On the other hand, ELSS is a market-linked scheme, which means you are investing indirectly into the stock market. Stock markets are volatile, so investments under stocks face ups and downs. Due to this, the returns from ELSS funds are always variable. On comparing both investment schemes, PPF and ELSS, for the last ten years, most of the ELSS funds grown above 10% CAGR (Compound Annual Growth Rate), which is significantly higher than PPF. For those looking for long-term growth-based investment options, ELSS may be a good option.

Also, read: Invest in PPF - 8 reasons you should know about

Tax benefits

When we talk about tax saving on investment, we mostly think of the fund which is going to be invested. But what about tax on capital appreciation! The Government of India offers a bunch of tax benefits exclusively on PPF, which makes this scheme entirely free from tax. Here are the tax benefits of a Public Provident Fund account:

- Entire investments under the PPF account are fully exempt from tax. Here's how! Contributions under PPF are eligible for tax exemption under 80C with an overall ceiling of Rs 1.5 lakh. For example, if you invest Rs.1,50,000 in a financial year, you can get a tax deduction of up to Rs 1,50,000.

- On maturity, return from PPF is also exempt from tax. You need not pay a penny as capital gain tax.

- Tax is not applicable on partial withdrawals.

ELSS (Equity Linked Savings Scheme) is also a tax-saving investment scheme. Investments in ELSS qualify for 80C tax deduction up to Rs 1.5 lakh per financial year. The investment scheme offers post-tax returns for long-term capital gains of up to Rs 1 lakh per annum is free from tax. However, 10 percent of LTCG (Long-Term Capital Gain) tax, without indexation benefit, will be applicable in the case of capital gain exceeds 1 lakh.

Maturity and Lock-in period

Public Provident Fund (PPF) matures in 15 years. You can not exit from PPF before maturity unless having some predefined critical situations. Although, you are allowed to extend the tenure of a PPF account by a block of five years. There is no limitation in account extension, so you can extend the tenure how much you want.

ELSS does not have any fixed tenure. You can hold an ELSS fund as much you can. Although, it has three years lock-in period. On completion of three years, ELSS funds allow unit redemption or exit from the fund.

Partial Withdrawal

Investment under Public Provident Fund (PPF) scheme is locked-in for 15-years. However, partial withdrawal is allowed if the age of the PPF account exceeds five years. Here are the rules for making partial withdrawals in PPF:

- Partial withdrawal is allowed only after the completion of 5 years of a PPF account.

- Maximum 50% of the total balance is allowed to withdraw

- You can make a withdrawal only once during a financial year.

On the other hand, there no such thing as partial withdrawal in ELSS. Corpus in an ELSS fund is strictly lock-in for three years. In an emergency, you can take a loan against an ELSS mutual fund.

Investment Limit

PPF falls under Government-sponsored Small Saving Schemes. So, there is an upper investment limit of Rs. 1.5 lakh in a Public Provident Fund account during a financial year. In order to maintain the account, one must deposit a minimum of Rs. 500 in a year. Unless the PPF account might get deactivated.

ELSS is nothing but a form of a mutual fund. Here no such upper limit is defined. You can invest as much you can with a lump sum or SIPs. The minimum amount of lump sum and SIP is considered by the fund house. But in general, you can expect a minimum investment under an ELSS mutual fund likely to be Rs. 5000 for a lump sum and Rs. 500 for a SIP.

Loan facility

If you hold a PPF account, you can take a loan against your Public Provident Account during a financial emergency. Here are the rules and conditions for getting a loan against a PPF account:

- A loan is only applicable during the 3rd and 6th financial year.

- Only 25% of the amount you have invested can be approved for a loan depending on the amount of the previous two years' deposit.

- An additional 1% interest rate is applicable for a loan against a PPF account. Such as, if you take a loan when the PPF fetches an interest rate of about 7.1%, at that time the loan rate will be 8.1%.

- On payment of loan dues within two months, paid interest will get refunded. Alternatively, we can say an individual can get an interest-free loan for two months against a PPF account.

- One can take more than one loan from a single PPF account. However, only one active loan is allowed at a time.

A loan against an ELSS is also allowed. Mutual Fund offers taking digital loans from banking and non-banking sectors. In the case of a loan, the lender bank holds the equivalent units of your mutual fund. The interest rate can vary from institution to institution. Until you repay the loan with applied interest, you can not sell those units held by the lending institution.

Recommended Article: PPF withdrawal, loan, pre-mature account closure rules

The Conclusion! ELSS or PPF which is a better investment option

Both ELSS and PPF schemes have their own set of benefits. Saying one better over another is not a wise judgment at all. Only perspectives can select a perfect option according to a situation. PPF is a secure saving scheme, but the return is quite a downside. On the other hand, ELSS has the potential to grow your money far more than the PPF. But the risk is also associated with ELSS funds. PPF is ideal for conservative investors who are looking for a tax-saving investment with zero credit risk. Anyone, apart from tax-savings, who can withstand market ups and downs and is able to take the risk of losing money in the worst-case scenario, can invest in ELSS Mutual Fund. Most of all, you can also invest in both schemes by investing some portion of funds in PPF as a debt investment, whereas, some portion ELSS funds for taking an equity exposure.