How to Save Money - 10 Simple Money Saving Tips

All we know about saving our money. But things get complicated to some extent while we are going to start it. You are reading this article, which means you are probably thinking ‘How to Save Money?’. Yes! That’s a great thing. It is not a big deal, how much you earn! The big deal is how much you save.

In this article, I am going to share with you some important tips that will definitely help you to move one step to your savings. Savings is nothing but a habit of making fewer expenses. All you need to reduce your expenses and focus on savings. Once you make these changes in your life, you will definitely achieve a stable future.

10 Simple Ways to Save Money

Savings is a known subject and all we know is ‘What is Savings?’! But how many of us start saving as soon as we know about saving? The number is limited. Because most of us think we are not ready for saving right now. Once income increases we will save a lot. Isn't it? But this kind of thinking might not be practical.

Money needs time to grow and how early you start, you will have fewer savings burden in the future. Savings is not a tough thing. All you need to make a mindset to save some portion of your income regularly. It does not matter how small it is. After a couple of years, you will see the impact of your small savings. Here are some money-saving tips for you:

1. Reduce Your Expenses

Expenses are the necessity of life. We earn to make our life comfortable. But deciding the comfort level is the most critical factor. Here are some important, but easy tips that have the potential to save your hard-earned money:

Note Your Expenses

If you want to save money, you have to control or limit your expenses. Try to make a note of your major and minor expenses as much as you can. You can use an excel sheet or any ledger account book mobile app. You can categorize your expenses as Rent, Utility bills, Entertainment, Travel, EMIs, etc.

Once you start creating expense notes regularly, you will be able to track those in the future. After a period, it will be easier to figure out your past expenses and their trends. This data will show you how much you lost and how much you could save.

Reduce Your Debt

Debt is not a bad thing at all. It's natural taking loans on emergency requirements of money or buying properties like homes, cars, etc. The money from all loans is compositely called debt. The money you borrow does not belong to you. You must pay it back along with some additional interest. If you want to save money, you need to make yourself debt-free. If debt-free is not possible for you, then you must try to reduce it.

You might wonder knowing how much a person repays against his/ her long-term loans. It can be double, triple, or even more of the principal loan amount. Try to avoid unnecessary loans. This small step can make a large impact on your financial stability.

Pay off Your Loans. But not Aggressively!

Paying off loans is very important. Non-payment of loans definitely harms your credit ratings. And there is a very high chance that lenders will not be interested in giving you a loan in the future. So, paying off loans on time is always good.

If you are thinking of paying your loan first and later you will go for an investment or a saving, you might not choose the right option. Yes, you will be debt-free soon and also get some rebates of interest. But repaying loans by stopping your saving is might not be a good step. The amount may be small, but you have to save some money along with your EMIs.

Don’t Fall Under EMI Trap

EMIs are great and help to own new things. Aren’t they? No! not necessary. EMIs are simply a money-making process by your lenders. EMIs are not a free thing. If I say most accurately, you are just buying time. You are bound to pay the principal along with additional interest, processing fees, etc. Try to purchase items with full payment instead of EMIs. Reducing EMIs is a clear potential for saving money 10 to 30% or even more. These small savings can even create a handsome corpus in the long term.

Reduce Your Credit Card Usage

Credit cards are popular credit instruments, effective for purchasing goods, converting payments into EMIs, etc. In case of a lack of cash, you can use this card for making payments.

A Debt Trap: Excessive credit card usage can eventually make a debt trap. You should limit your purchase using credit cards. If you fail to pay back the credit, the card issuer charges a very high-interest rate. So, try to pay off full dues before the last date of payment.

Minimum Due Trap: Minimum-Due is a little portion of your outstanding that you can pay on or before the payment date. Don’t fall into the minimum-due payment trap. With this option, you are paying neither principal nor interest. You are just paying a penalty charge for a lifetime.

Avoid Too Many Personal Loans

In an emergency, a personal loan can be a good option. It takes less time to get approval without collateral. But remember, personal loans take a very high rate of interest 14 to 20% per annum or even more. To make yourself debt-free, you should avoid personal loans unless you have an emergency.

Cancel Unutilized Monthly Subscriptions

Getting informative or entertained is not a bad thing at all. There is no shortage of paid services, whatever it is a newspaper or Netflix. If you have multiple paid subscriptions and are not using any of them, you should cancel it without a second thought. If you save this small amount of money per month, you can even make a lump sum after a couple of years.

2. Set Some Financial Goals

Set a goal whenever you want to start new savings. Creating goals is the best way to save money. You can have more than one goal like buying a new car or property etc. Split money into different saving goals. The benefit is, if you have to break one saving, that does not impact on another.

.jpg)

Savings goals can be for a short time or a long time. Suppose you want to purchase a new property within the next 2 to 3 years, you should create a short-term saving goal. And suppose you are thinking about your pension for old age, then think of a long-term saving goal.

Once you set some financial savings goals, it will be much easier to manage and continue saving for a long period. Here are some examples of short-term and long-term goals.

| Short-Term (1-4 Years) | Long-Term (Above 4 Years) |

| Purchasing New Car | Child’s Marriage, Education |

| Vacation | Retirement |

| Medical Emergency | Purchasing New Property |

| Renewals | New Business |

3. Automate Monthly Savings

If you save a certain amount of money monthly, try to automate it. Most banks or financial institutions offer automated savings investments such as recurring deposits, SIPs, etc.

Automation in savings is nothing but an automatic fund transfer between multiple accounts on an interval. Once you choose this service you don't have to worry about savings. Your savings will be completed automatically as per your instructions.

This kind of practice creates discipline in your financial life and eventually saves a lot of time and also reduces your headache of saving every month or week.

4. Pick Some Long Term Saving Instruments

Long-term savings are ideally wealth-making tools. It's better to have at least one long-term saving scheme. It creates wealth that can be beneficial for various purposes like children's higher education, marriage, etc. It's advisable, long-term savings or investment should be secure enough.

There is no shortage of long-term saving schemes in India. You can choose as per your choice and start saving money. Some popular long-term investment options in India are likely Sovereign Gold Bond, PPF, Stocks, Mutual Fund, Bonds, etc. You can choose the appropriate one for yourself.

5. Create a Pension Fund

Think, you are at the age of 60 not capable of earning, and you need money to manage your expenses. What will happen! Pension is the tool that can help you in your old age. Every individual must have a pension plan.

You can choose a pension fund. Pension funds are usually long-term saving instruments. On maturity of a pension fund, you can expect a regular income after your retirement.

In India, a popular Government-sponsored pension scheme is the National Pension Scheme (NPS) that is managed by PFRDA. Government employees or any individual can opt for this pension scheme.

6. Invest in TAX savings schemes

You can save money by investing in TAX savings schemes. Tax savings schemes offer additional tax deductions over the investment. As an example, you can reduce your tax up to 1.5 lakh by investing in a tax-saving Saving Scheme that falls under the 80C IT Act.

If you are an income taxpayer, it's better to save money by reducing the tax. A variety of tax-saving instruments are available in India. It may be savings, investment, or even insurance. By investing in these types of instruments, you can save about 1.5 to 2.5 lakhs a year. Here are some popular tax-savings investments schemes in India:

- ELSS (Equity Linked Saving Scheme)

- PPF (Public Provident Fund)

- SSY (Sukanya Samriddhi Yojana)

- NPS (National Pension Scheme)

- ULIP (Unit Linked Insurance Plan)

- SCSS (Senior Citizen Saving Scheme)

- Tax-Saving Fixed Deposit

- Life Insurances

7. Try to be an Investor

Saving and investment are different by their nature. Investment is putting some money into any business, projects, assets, etc. Some popular investment instruments in India are stocks, real estate, precious metals, Mutual Fund, Bonds, etc.

You can not expect a fixed return from an investment. It depends on the performance of the invested asset.

Investments also carry certain capital risks. However, you can expect a better return than savings from a long-term investment. If you are a new investor, you can try to invest with 5 - 20% of your capital.

Start Early to Invest

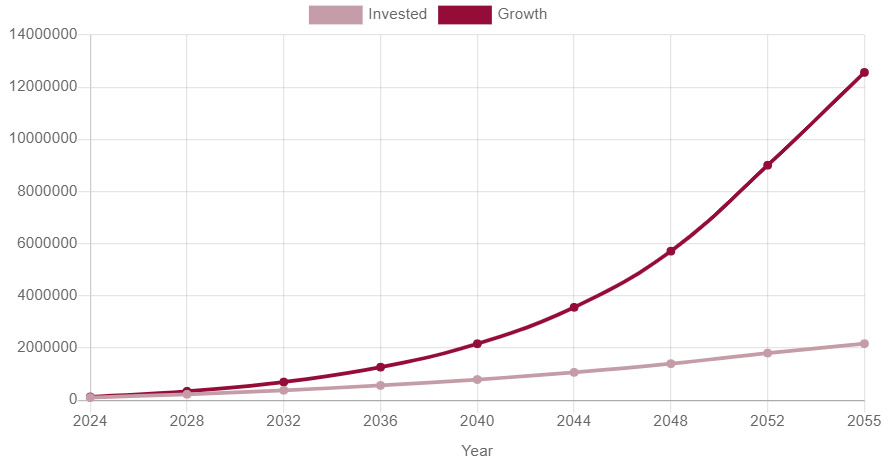

Did you know Albert Einstein once said that the Power of Compounding is the 8th wonder of the world? Early investors can make crores with a small investment with the help of the power of compounding.

Let us take an example: suppose your age is 20 and invest Rs.2000 per month, and continue to invest in the next 35 years with a 5% increase in investment per annum. Assume the rate of return will be approximately 10% per annum. Do you have any idea how much you will get at the age of 55? Believe it or not, you will get approximately 1.5 crores by investing just 21.5 lakh. You can also use our SIP Calculator to calculate returns of step-up investments.

It is not impossible to be a millionaire with small investments. All you need to start saving your money early and continue it for a long time.

8. Allocate Gold in Your Investment Portfolio

Gold is the most popular precious metal in India. Indian households purchase this yellow metal mostly in the form of jewelry for making liquid assets. Gold can be a pretty good investment option too. Not only in India, but investors around the world invest a certain amount in Gold in their investment portfolio for hedging purposes. During the crash of the stock market or recession value of Gold rises. Gold is not an ideal investment option for getting higher returns. However, it has the potential to beat inflation. Gold is also known for its liquidity which can be purchased or sold anytime. You can buy Gold in various forms like Jewellery, coins, gold bonds, Gold - ETF, etc.

9. Create an Emergency Fund

Saving emergency funds is extremely important for an individual. The emergency fund must be a secure and high-liquid fund. It is advisable to keep a certain amount of money for your family expenses of at least six months in the emergency fund. As an example, if your monthly family expense is roughly about 75k, you should at least save 75 x 6 = 4.5 lakh into a secure savings fund. This fund can be useful during financial emergencies like certain medical expenses, job loss, etc.

10. Buy Medical Insurance

Medical emergencies are uncertain. You should allocate a fund from your savings for medical emergencies. Otherwise, it can take off your hard-earned money. It's better to have good medical insurance for you and your family. Medical insurance does not offer wealth creation, although it significantly reduces medical expenses. Always try to pick medical insurance that has a higher claim settlement ratio and good network hospital coverage.