Do Investing In NIFTY Next 50 Make Sense?

Passive investing is a flourishing industry that has gained momentum in the last couple of years. This pace has resulted in Asset Management Companies fetching various passive funds to track several indices. And this brings you to the very important reason why you should understand investing in an equity index. Index investing is nothing but investing in a group of listed companies unitedly. And not buying stocks individually. This means, you are participating in equity but you don't need to pick or find the best stocks for you. Index investing is one of the underrated instruments, that has the potential to grow your hard-earned money significantly with minimized risks. Let's deep dive into this topic and we will discuss and compare the most popular indices i.e. Nifty Vs. Nifty Next 50.

Does investing in the NIFTY Next 50 make sense? If yes, which will be a better decision? In this blog, we will uncover all the necessary details related to NIFTY-Next 50 Investment.

NIFTY Next 50: What is it?

NIFTY Next 50 is the stock market index that represents 50 companies in NIFTY 100 excluding the NIFTY 50 companies. It strives to assess the operation of large market capitalization companies. In simple words, these are the companies that occupy the position of 51-100 in market capitalization in India.

The stocks in the NIFTY Next 50 are potential companies that can be included in the NIFTY 50 in the future. When looking at the last two decades, around 40 stocks have been promoted to NIFTY 50.

Every stock in the NIFTY Next 5O has a different weight because of the market cap criteria. This, the more the market cap of the company, the more is its weight in the NIFTY Next 50 index.

In the case of allocation of every stock, the holding of NIFTY Next 50 is more evenly distributed in comparison to NIFTY 50. It is also the least concentrated biggest-cap induces among NIFTY 50, NIFTY Next 50, and NIFTY 100.

The Consumer sector occupies the top sector in the NIFTY next 50 index. It has a remarkable contribution from other sectors like consumer service, financial services, metals, and pharma. In fact, the top 5 sectors form 62% contribution in NIFTY next 50. It is the least amongst the 3 large-cap indices.

Comparison: NIFTY Next 50 And NIFTY 50 Index

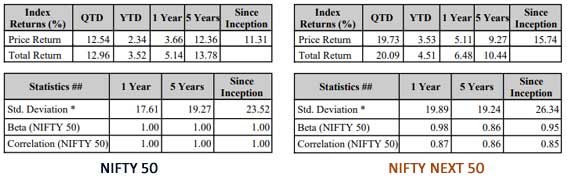

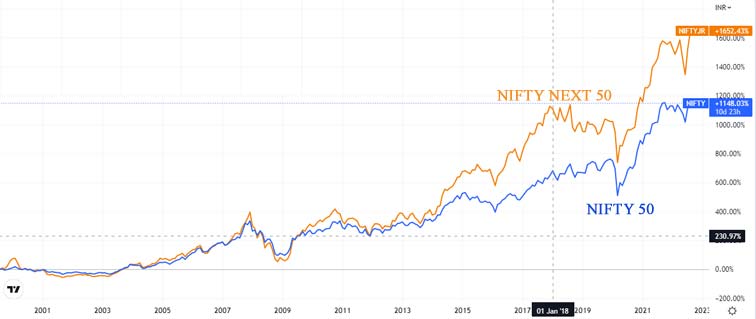

- In the last few years, the NIFTY Next 50 has given a 16% return (CAGR) in comparison to the 13.5 % return provided by the NIFTY 50 Index. The NIFTY next 50 has also outperformed 255 bps in tenure of 10 years.

Historical Returns Nifty 50 Vs. Nifty Next 50 Since Inception | Source: NSE Fact Doc (August 30, 2022)

- In 2015, NIFTY Next 50 showed a remarkable performance which has improved over the years due to the developing sectors that have gained more importance than the old ones.

- Returns From The NIFTY Next 50 Index: The NIFTY next 50 has seen both ups and downs. Still, when we see the performance for the last 15 years, it has provided a good 14.2% average annual return.

- NIFTY Next 50 has not just exceeded NIFTY 50 but has seen a lower drawdown in the bear market cycle.

- Night Next 50 is more towards Consumer goods, Consumer Services, Pharmaceuticals, Financial Services, and Metals. NIFTY 50 is more inclined toward Oil, Gas, Financial Services, IT, and Consumer Goods.

- The offering of the top 5 sectors in NIFTY Next 50 is 65.9%. This means that it is more diverse. The offering of the top 5 sectors in NIFTY 50 is 82.9%. This means it is less diverse.

Performance chart Nifty 50 vs Nifty Next 50 | 2000 to 2022

Why Should You Invest In The Nifty Next 50 Index?

- Diversification: One of the significant ideas of investment is reducing risk by diversifying your incessant portfolio. Diversifying your portfolio in a variety of asset classes can reduce risk at times when the market crashes. The NIFTY Next 50 is nicely diversified across pharmaceuticals, consumer goods, and metals, even though it has a weightage of about 19% in financial services. For example, the NIFTY 50 index fund will execute satisfactorily in a polarized or narrow market where only a few sectors perform well. The NIFTY Next 50 concentrates on developing sectors and companies of the future. It proposes an outstanding chance to diversify your portfolio beyond the traditional areas.

- Passive Investing: A determination to invest in a passive product is made based on the risk-reward behavior (in the long run) and composition of the index it tracks. Passive investing in NIFTY Next 50 is a flourishing initiative now. This impetus has emerged in AMCs generating various passive funds to track several indices. And this is why you need to understand investing in index mutual funds.

- Low-cost Investing: The primary benefit of the equity index instruments is lower maintenance/ expense costs. Let's take an example of two mutual funds 1. Nifty Next 50 Index fund and another any Bluechip fund. You will notice, that the expense ratio of the index funds is always cheaper than most of the active funds. Because passive funds follow their corresponding index. So, the contribution of fund managers is very limited.

- Inflation Beating Returns: The majority of the investment products that gain popularity suddenly are due to their recent performance. The NIFTY Next 50 index is not an exception here. With a CAGR of 18.6% in the past five years, it has beaten the NIFTY 50 (13.1 percent). By investing in NIFTY-Next 50 ETFs in a low-cost manner, you can gain exposure to the top 100 names in the listed universe. Also, you get stocks of these NIFTY Next 50 companies at a nicer valuation as they have yet to obtain status as market leaders.

- One of the Safest Equity Investment Instruments: Investors advise investing in equity shares for the long term if they wish to build wealth over a period of time. Equities have the possibility to earn good returns. In fact, these returns can be much better than the other investment options. They offer returns higher than inflation. This is important because returns that are lower than inflation are lost and lose your purchasing power.

Timing for Investing/ Reinvesting In The Nifty Next 50 Index

Let's discuss the million-dollar question... When should I invest in Nifty Next 50 Index? Well, no one can predict the market, so telling the timing is much more difficult. However, these are a few points you can consider while investing...

During the Declining Market/ Down Market

There’s no such good time or bad time for investing in index funds using SIPs. The primary advantage of SIP, it can easily handle market volatility. Although, during a market crash or extreme selloff, it’s advisable to accumulate more using lumpsum investment. This action eventually, will increase the CAGR significantly. But, for the lumpsum investment, it's advisable to invest when the market or index is cheaper.

Now how to know if the market is cheaper or costlier? Well, this is not rocket science understanding market is costly or not. Just observe the long-term index chart, and you will be able to understand the market’s situation. But this needs a basic chart reading skill. However, there’s another easier and more effective way to understand the market is by observing the P/E ratio.

When Index is Cheaper or Lower P/E

The P/E ratio is called price to earnings ratio. An index P/E ratio evaluates the average PE ratio of the 50 companies that comprise any equity index. It is used as a measure to understand if markets are cheap or expensive. So we can see an index P/E can tell stock market health. In India, an Index P/E ratio above 20 is considered overvalued, and a value less than 20 is undervalued. However, it can vary from index to index.

Such as an example, the Nifty 50 PE range (Low and high) is typically from 11 to 38. And, Nifty Next 50 PE range is about 7 to 44. This data shows Nifty Next 50 is more volatile and less mature than the Nifty 50. But the interesting thing is more volatility means more opportunity for investing and more return. That's why since its inception Nifty Next 50 has given a better return than the Nifty 50 Index. So, according to historical data, P/E below 25 is good for investing in the Nifty Next 50 index.

Source: UR Financial Companion Android App

According to past performance, whenever the NIFTY Next 50 had a lower PE ratio, it provided better returns. You need to check NIFTY NEXT 50 P/E before investing lumpsum.

How to invest in the NIFTY Next 50 Index

In the environment of the current volatility in equities and not ignoring the quintessential, uncertain behavior of the asset class, a diversified, low-cost passive investment method can strengthen the investment portfolios.

Index funds with less expense and fewer tracking errors are the best options for investing in the NIFTY Next 50 Index. Remember that higher liquidity matters in case you wish to invest in ETFs via secondary markets.

With a diversified index, you will get exposure to many sectors through a single investment.

Invest through Passive Mutual Funds

Index funds are the only option to invest in the NIFTY Next 50 index using mutual funds. Mutual funds are good for investing in NIFTY Next 50 as they hold the opportunity to reap potentially higher returns in comparison to the traditional investment options. The reason behind the return on mutual funds is linked to the performance of the market. Therefore, if the market is performing well, your mutual funds will do exceedingly well. These mutual funds are passive funds. Passive mutual funds arrive with various advantages over other types of mutual funds.

As passive mutual fun doesn't require a fund manager, the cost associated with it is relatively low. In the long run, they outperform a basket of stocks as they track the index like the NIFTY 50 or Sensex. Passive funds are also good for beginners who don't have an in-depth knowledge of how the market works but want to take his/her chance.

Last but not the least, mutual funds offer phenomenal diversification. Let's understand how this works. When a mutual fund is actively managed and offers diversification, it is not even close to what a passive mutual fund offers. This is true because passive mutual funds track indexes. These indexes consider the best stocks from nearly all industries and sectors. This manages to reduce the risk in an extensively more promising way than other types of mutual funds.

Invest through ETFs (Exchange Traded Funds)

Equity is a good investment option with long-term investment and a high-risk appetite. The safety percentage of equity makes investors invest in large-cap companies and away from the high returns promised by small and mid-caps. Well, investors can enjoy the benefit of both, which means the opportunity to get higher returns with relative safety. This is possible through Exchange Traded Funds or ETFs.

Some NIFTY Next 50 Index Fund with good returns in the past are ICICI Prudential NIFTY Next 50 Index Fund, UTI NIFTY Next 50 Index Fund, IDBI NIFTY Junior Index Fund, and DSP NIFTY Next 50 Index Fund.

The benefits of investing in ETFs are the convenience of exchange trading. ETFs also come with low costs with lower tracking errors than index funds. Net asset value is not impacted by the inflows and outflows in the ETF. Having a Demat account, you are free to invest using ETFs.

Conclusion

The best way to invest is to reduce the risk exposure by diversifying your portfolio. One of the best ideas to do so is investing in the NIFTY Next 50. The NIFTY Next 50 is well diversified. The present composition of the NIFTY Next 50 Index comprises heavyweights from sectors like financial services, metals and mining, consumer services, and FMCG to quote a few. Presently, the main 10 stocks are greatly conquered by consumption-based stocks which are bound to profit from the fast-thriving domestic economy and impressive export opportunities happening due to India’s expanding manufacturing superiority in the global economy. These companies are nicely-positioned to profit from the all-around economic growth in main domestic sectors.

If you wish to invest in Index funds- NIFTY Next 50 makes sense as it is much more evenly diversified. The past couple of years has given great returns, beating the NIFTY 50 index. Always remember that your investment should be according to your risk profile, investment requirements, and asset allocation.