NPS Withdrawal Rules - Premature Exit Rules

The National Pension System (NPS) is one of the popular retirement investment schemes in India. The Government-sponsored market-linked investment scheme is beneficial for those who want to create a corpus for their retirement. The National Pension System is regulated by the PFRDA (Pension Fund Regulatory and Development Authority) under the Indian Parliament act. The scheme was initially introduced in 2004 for Government employees only, but later it opened for all residents of India. Individuals having an age bracket of 18 to 65 can open an NPS account.

NPS comes with two types of accounts those are Tier-1 and Tier-2. Tier-1 is the primary and mandatory account type, whereas Tier-2 is optional and not for retirement purposes. In this article, we will talk only about the Tier-1 account as this is the primary account under the NPS scheme. The minimum investment under a Tier-1 account in a financial year is Rs. 500, and there is no upper limit capping in this scheme.

How NPS Works

NPS is a simple long-term investment scheme. After opening an NPS account, an individual needs to continue it till his/ her retirement age of 60. On successful account opening subscribers are greeted with a unique PRAN number as well as a physical pension card. The investment under NPS falls under the 80C and 80CCD (1B) income tax act that offers upto 2 lakh tax deduction for each financial year. On maturity, the account holder is free to withdraw a maximum of 60% of corpus as a lump sum, and the rest amount must be used in order to purchase an annuity plan that offers periodic returns over a lumpsum investment. Lump-sum withdrawal of upto 60% is completely tax-free.

NPS Withdrawal Rules

Opening and managing an NPS account is easy. A subscriber can see portfolio balance or manage his/ her account directly from the NPS official portal. Let's discuss the rules in order to make a withdrawal from an NPS account.

NPS Withdrawal Rules - On Superannuation

During superannuation a subscriber can opt for options which are discussed below:

- A subscriber has to purchase an annuity at least 40% of his/ her corpus and the rest amount of 60% can be withdrawn as a lump sum.

- PFRDA allows 100% withdrawal if the total corpus is less than or equal to Rs 5 lakh, which was 2 lakh earlier. The pension regulator has notified this change in a gazette notification published during July 2021.

At the age of 60 or at the time of superannuation, the following options are available to NPS subscribers-

- Continuation of the NPS account: An NPS subscriber can continue the account till the age of 70 years.

- Deferment: During the age of 60, subscribers have the choice of either withdrawing or defer superannuation for the next 10 years. There are multiple deferment options available under the NPS scheme:

- Defer only Lump-sum withdrawal

- Defer the only Annuity

- Defer Both i.e. Lump sum withdrawal as well as annuity

- Start Pension: Pension will start as soon as a subscriber exits from the NPS scheme. The amount of pension will be decided based on annuity purchase and annuity rate.

NPS Withdrawal Rules - Before Maturity

Although NPS is a long-term investment scheme, a subscriber has multiple options like partial withdrawal and premature exit. Let's discuss one by one:

#1. Partial Withdrawal

During a financial emergency, an NPS subscriber has an option to withdraw a portion of his/ her contribution. Here are the rules of making partial withdrawals from an NPS account:

- The age of the NPS account must be three years or more

- Only upto 25% of the self contribution is allowed to withdraw in a single request

- One can make a maximum of three partial withdrawals during an NPS account lifespan

- Partial withdrawals are only allowed for critical cases of financial emergency like the following:

- Children's Higher Education or Marriage

- Purchase or reconstruction of residential house

- Treatment of life-threatening diseases

#2. Premature Exit

National Pension System (NPS) allows premature exit from the scheme before the age of 60 or maturity. But certain conditions need to fulfil in order to prematurely exit from an NPS scheme:

- A subscriber needs to continue account for at least 10 years

- Exit before maturity allows only 20% of tax-free lump sum withdrawals

- At least 80% of the corpus has to be used for purchasing an annuity

- If the total corpus amount is less than or equal to 2.5 lakh, which was 1 lakh earlier, the subscriber can withdraw 100% as a lump sum. The Pension Fund Regulatory and Development Authority (PFRDA) notified this change in a gazette notification published during July 2021.

Also read: How to set up SIP for NPS using D-Remit service

#3. Death of Subscriber

In case of the death of the subscriber, the nominee or legal heir can close tha account and withdraw the entire corpus. Necessary Documents for claiming are following:

- Original PRAN Card

- KYC Documents

- Cancelled Cheque

- Registered death certificate of the subscriber

- Advanced stamped receipt to be duly filled and cross-signed on the Revenue stamp by the claimant

NPS Withdrawal Process

Withdrawal from an NPS account can be done in two ways either online or offline. Let's know one by one:

Partial withdrawal from NPS account Online

- Visit NPS subscribers online portal

- Login into the account

- Navigate to 'Transact Online' from the primary menu bar

- Click on the 'Partial Withdraw from Tier 1' under the 'Withdrawal' submenu option to begin

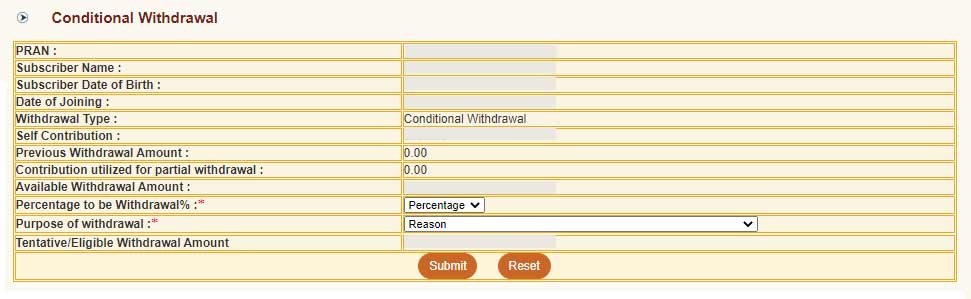

- Proceed by clicking the 'Submit' button on the 'Initiate Conditional Withdrawal' form

- In the 'Conditional Withdrawal' form provide the following inputs:

- Percentage to be Withdrawal (Max 25%)

- Purpose of withdrawal

- Then click on the 'Submit button.

- On submission, a form will be generated. Subscriber needs to print the form and send it to the nodal office along with supporting documents.

- Approval of the application can take few days. Once the application is approved, the fund will reflect in the linked bank account within few days.

Partial withdrawal from NPS account Offline

A subscriber needs to submit NPS partial withdrawal form along with supportive documents to the nearest POP (Point of Presence) service provider like a bank, post office, etc.

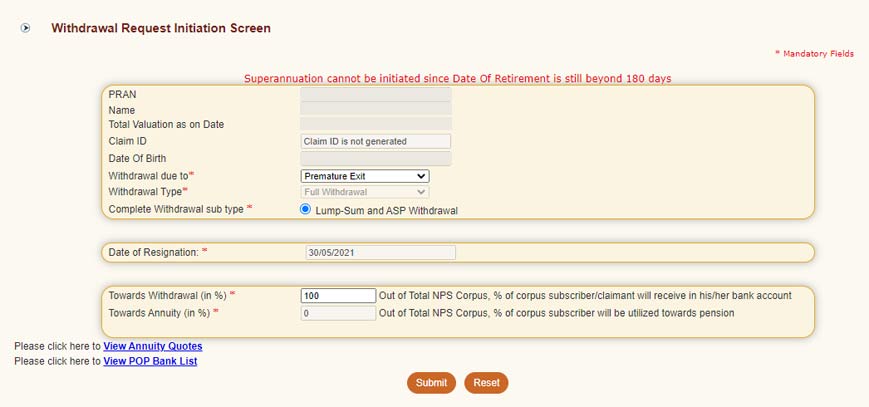

Premature Exit from NPS Online

- Visit NPS subscribers online portal

- Login into the account

- Click on 'Initiate Withdrawal Request' under the 'Exit from NPS' menu

- Fill the form and click on the 'Submit' button

- On submission, a form will be generated. Subscriber needs to print the form and send it to the nodal office along with supporting documents.

- Approval of the application can take few days. Once the application is approved, the fund will reflect in the linked bank account within few days. In the case of a portfolio balance of more than 2 lakh, the subscriber needs to purchase an annuity worth 80% of the entire corpus.

We have covered all aspects of withdrawals under the NPS scheme. However, if you have any doubt or further queries related to this topic, feel free to ask in the comment section.

Recommended Article: PPF vs ELSS: Detailed Comparison & Which is Better