Home Loan Prepayment Calculator - Calculate EMI with Pre/ Part Payment

What is the Home Loan Prepayment Calculator?

The home loan prepayment calculator is an extensive version of the home loan EMI calculator. With this calculator, you can estimate your future EMIs for a home loan within just a few clicks. However, we have done something practical for you. As we all know these kind of loans, especially home loans, used to be long-term tenure and carries a huge interest liability. People usually try to reduce their tenure by additional payments called prepayments or part payments. Now, this prepayment calculation is quite difficult on pen & paper. So, finlive's Home Loan Prepayment Calculator gives that edge you so that you can add prepayment factors while EMI calculators.

How to use the Home Loan Prepayment Calculator?

Well, using the Home Loan Prepayment Calculator is pretty easy and convenient. All you need to fill up the following inputs and click on the 'Calculate Now':

- Loan Amount: The principal amount you are supposed to take a loan from the bank

- Tenure: The duration of the loan in years

- Rate of Interest (%): Applicable ROI

If you wish to calculate including prepayments, just click on '+' button from 'Add Prepayments' section. This will open a new input prompt that will ask for the following information:

- On Month *: When you will make that prepayment. Suppose you want to prepay after 2 years, then you can fill with 25.

- Pre-Pay Amount *: The amount you want to pay

.png)

Like this, you can add multiple prepayments with your EMI calculation.

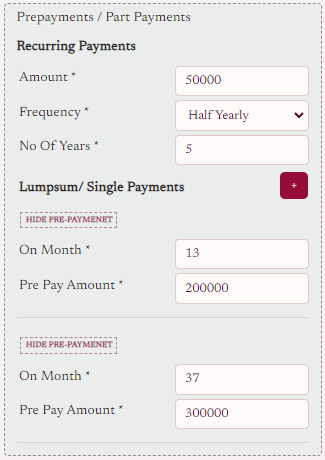

How to use Multiple Prepayment Options?

You can consider multiple prepayment options during Home Loan EMI calculation. This calculator allows recurring repayments and lumpsum or one-time part payments with a single calculation.

- Recurring Payment: The recurring repayments option allows you to fill in repayment value, frequency (like yearly, half-yearly, etc) & number of years you wish to continue the recurring prepayments.

- Lumpsum/ Single Payments: On the other hand, you have options like prepaying principal as lumpsum. The good thing is you can add more than one lump sum payment option.

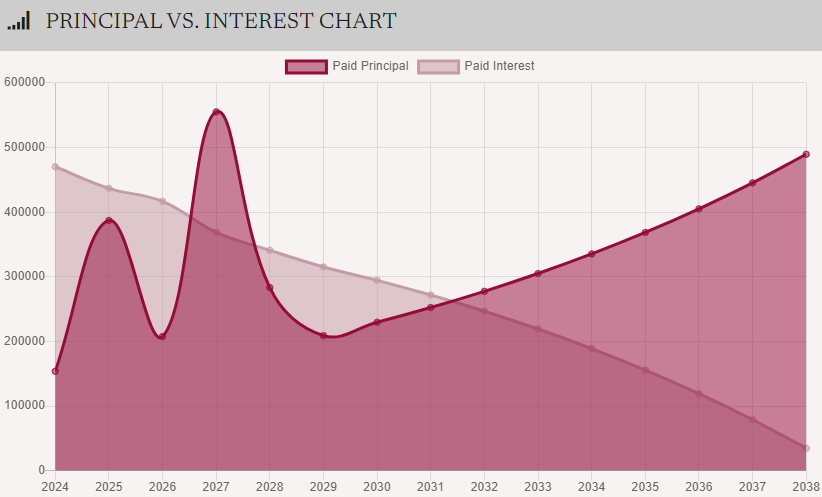

What is Principal Vs. The interest Chart?

Principal Vs. The interest chart lets you measure the prepayment impact during the loan tenure. The higher curves are the pictorial representation of your lumpsum pre/ part payments.